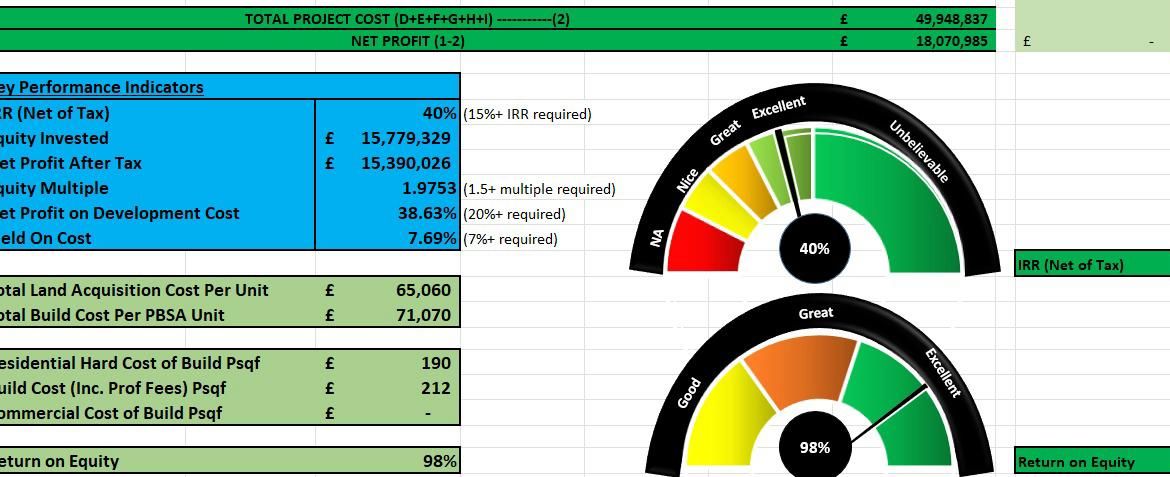

The Client dealt in acquiring land for the purpose of development of PBSA (Student accommodations)/PRS (Built to rent/Built to sale), they acquired planning to develop large buuildings for the said purpose and after renting them for 2-3 yrs or such appropriate time, they sold the projects. They required a working model –

1. To take into consideration all these elements

2. that accepts basic inputs like land-acquisition costs, construction/built costs, marketing and financing and other similar costs and basic revenue functions like avg rent per week or similar

3. calculate all the KPIs fo the proposed deal, which will outline their IRR, Return on Equity, GDV etc

Attached is a master model which I had created for the same purpose in PDF format as the model is not available to be used and is just uploaded for the purpose of portfolio to showcase my works.